Labour Costs

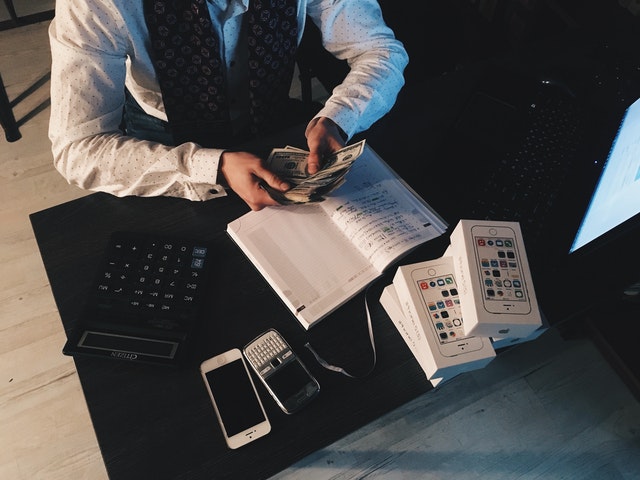

Labor expenses indicate the costs and value of the employees involved in a project. Labor is commonly measured in time—the amount of time that a team member spends working on the project (usually in hours or days). Labor time has a monetary value in most businesses that may be quantified based on that person’s entire salary (pay rate and benefits). Such quantification is common for employees in the private sector (e.g., dollar rate per hour), but it is less common for government employees. But the point is that labour time has a cost to the organisation that may be calculated based on the employee’s salary and working hours.

The majority of the items in the above list are typical direct expenses, which are expenditures for real objects or services purchased and recorded expressly for the project. Travel charges or computer gear and software purchased or leased particularly to assist the project are examples of direct expenditures. Direct expenses also include monetary expenditures for acquired services (for example, charges for a GIS contractor for data collecting or application development) as well as other monetary expenditures that are directly assigned to the project.

Indirect costs

Indirect costs are costs made by an organization while carrying out a project that is not directly accounted for or recorded as part of the project. As a result, indirect costs are frequently totaled for the entire business and then allocated to specific projects. Indirect costs, often known as overhead, comprise items such as building rent and operating costs (utilities, maintenance, and custodial services); insurance fees; tax payments; staff training not linked to a specific project; and expenditures for office furniture, equipment, and computer hardware that are not accounted for via individual initiatives. Employees’ time that is not attributed to a specific project and so does not generate revenue (marketing and sales staff) is considered overhead.

Billable rates are calculated by multiplying an employee’s total remuneration by the organization’s other expenditures. Private enterprises may also use a different sort of multiplier to account for predicted profit. Other sorts of multipliers may be used to compute labour rates in some companies.